April 8, 2024 update: The SEC has stayed its climate disclosure rule pending legal challenges.

On March 6, 2024, the Securities and Exchange Commission (SEC) finalized its long-awaited landmark rule requiring public companies to disclose climate-related risks and their financial impacts. While this marks a significant step toward increased transparency and investor confidence in the face of a changing climate, there have also been some setbacks along the way. Notably, certain provisions from the original SEC climate disclosure rule were dropped. And more recently, a US federal appeals court temporarily halted the new SEC climate rule from moving forward. In spite of these hurdles, it’s unlikely to change the 2026 deadline set in the SEC climate disclosure timeline, so businesses need to prepare. In this post we’ll delve into the key aspects of the revised rule, its implications for businesses, and how they can get ready for the SEC climate disclosure requirements.

Register for/watch the webinar “The Role of Carbon Credits in Credible Climate Claims” to learn how to harness the benefits of carbon credits while staying compliant with climate regulations.

What is the SEC climate disclosure rule?

The SEC climate disclosure rule aims to provide investors with clear, comparable, and reliable information on how climate change can impact a company’s bottom line. According to SEC Chair Gary Gensler, the rule “will provide investors with consistent, comparable, and decision-useful information, and issuers with clear reporting requirements”. This aligns with global efforts to standardize climate-related financial disclosures, enhance investor confidence and make sustainable businesses more competitive in the international market.

Who is impacted by the SEC climate disclosure final rule?

The SEC climate disclosure rule primarily affects public companies registered with the SEC.i Specifically, the rule impacts:

- Large Accelerated Filers (LAFs): These are the largest publicly traded companies with a public float of $700 million or more. They will be the first to comply with the SEC climate rule and have the most stringent reporting requirements, with disclosures required in annual reports for fiscal years beginning January 1, 2026 onward.

- Accelerated Filers (AFs): Public companies with a public float exceeding $75 million but falling below the LAF threshold are considered accelerated filers. They will face SEC climate disclosure requirements at a later date than LAFs for some items, but some disclosures will be required for fiscal years beginning January 1, 2026 onward.

- Large foreign private issuers: Foreign companies with a US listing that exceed a specific public float threshold are also subject to the rule.

It’s important to note that while the rule directly applies to public companies, it has a ripple effect:

- Investors: Gain access to standardized and reliable information on climate-related risks impacting companies they invest in.

- Financial institutions: Can better assess climate-related risks associated with their loan portfolios.

- Rating agencies: May incorporate climate-related disclosures into their credit ratings.

What businesses need to know about the SEC climate disclosure requirements

The SEC climate disclosure rule outlines specific requirements for public companies. The key requirements for affected companies are:

- Emission disclosures: Companies will need to disclose both Scope 1 and Scope 2 greenhouse gas (GHG) emissions. Scope 1 covers direct emissions from a company’s operations, while Scope 2 includes indirect emissions from purchased electricity, heat, or cooling. Independent reviews of these disclosures will be required with the timeline dependent on the filer’s status.

- Climate-related risk narratives: The SEC climate rule requires companies to provide a narrative description of climate-related risks that could have a material impact on their business strategy, financial condition, or results of operations. This includes physical risks like extreme weather events and transition risks arising from policy changes or market shifts towards a low-carbon economy. Companies will also need to describe how they are identifying, addressing, and managing climate-related risks.

- Impacts of severe weather in financial statements: Companies will need to disclose the financial impacts of severe weather events and other natural conditions in their audited financial statements.

- Climate-related targets and goals: Companies will need to disclose information about climate-related targets that have or are likely to materially affect business operations or financial condition.

What’s the SEC climate disclosure timeline?

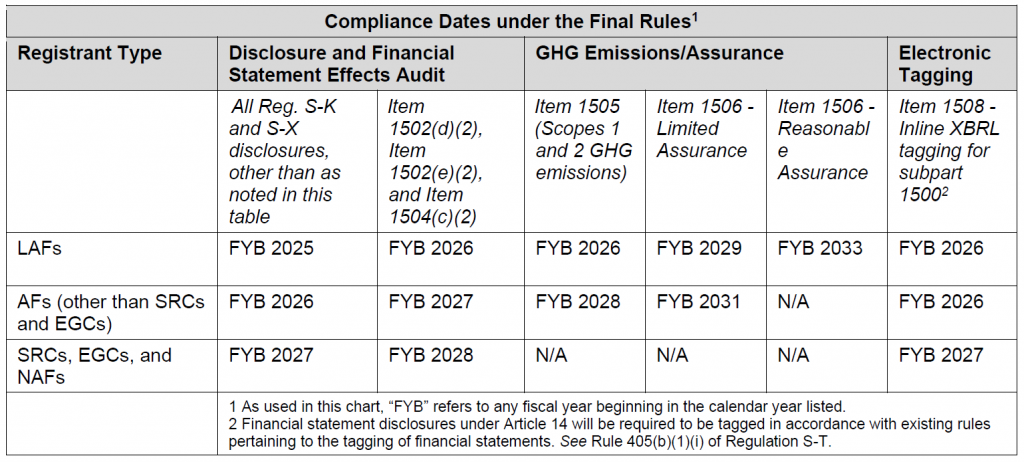

While the SEC climate disclosure timeline is still unclear due to the temporary court hold, the rule will become effective 60 days after it’s published in the Federal Register. Once it goes into effect, compliance will follow a phased implementation approach as follows:

Phased implementation: The SEC climate disclosure rule recognizes the varying capabilities of companies. Larger companies categorized as “accelerated filers” will have to comply sooner as shown in the table below. Smaller companies, including Smaller Reporting Companies (SRCs), Emerging Growth Companies (EGCs), and Non-Accelerated Filers (NAFs) will have a phased-in approach with extended deadlines.

Source: SEC

Why companies should buy carbon credits to use in their SEC climate disclosures

The SEC climate disclosure rule doesn’t mandate specific emission reduction targets. However, companies looking to demonstrate sustainability leadership can utilize the carbon credit market in parallel with internal emission reduction. Research has shown that companies who purchase carbon credits decarbonize 1.8 times faster than those who don’t. And, because the SEC climate rule requires companies to disclose mitigation strategies, buying carbon credits is an effective way to show tangible effort, prove real reductions, and be compliant.

Purchasing carbon credits or investing in a carbon credit portfolio can:

- Offset emissions: Companies can use carbon credits to mitigate their unavoidable emissions, helping them achieve compliance with the SEC climate disclosure rule.

- Meet reduction targets: Companies with ambitious science-based decarbonization goals can utilize carbon credits alongside internal emission reduction efforts to reach their targets. To learn more about the role carbon credits play in credible climate claims, register for/ watch the webinar with Cloverly and VCMI.

- Achieve net zero and beyond: Companies can demonstrate climate leadership by increasing investment annually in carbon removal projects beyond net zero. These investments can be used to mitigate past emissions, mitigate beyond value chain emissions, or make positive climate contributions.

Preparing for compliance: taking action now

With the SEC climate disclosure rule taking effect, companies need to start preparing for the new reporting requirements. Here are some key steps:

Calculate and report emissions

The rule specifies that companies use the Greenhouse Gas Protocol (GHG Protocol) to calculate Scope 1 and Scope 2 emissions. This internationally recognized standard provides a robust framework for measuring and reporting greenhouse gas emissions. Establishing internal controls early is crucial for accurate reporting.

Verifying the accuracy of reported data is equally important. The SEC rule allows companies to use independent third-party attestation for their GHG emissions data, which enhances investor confidence in the reported figures.

Assess and disclose climate risks

Companies need to develop a comprehensive approach to climate risk management. This involves identifying potential climate-related risks, assessing their likelihood and potential financial impact, and implementing mitigation strategies.

Climate risk management should be integrated with the existing enterprise risk management framework. Companies can then disclose the identified climate risks, potential impacts, and the associated risk management strategies in their SEC filings.

Improving climate resilience is one of the seven key business benefits of carbon credits – download the white paper to learn more.

Prepare climate-related targets, goals, and progress

Companies need to disclose any climate-related targets that have or could materially affect their operations or financial condition. This includes any expenditures and impacts on finances as a result of the target, or actions taken to make progress toward meeting such a target. Buying high-quality carbon credits is an essential element in most credible decarbonization plans – reach out to Cloverly today to learn how to get a head start.

Transparency, sustainability, and strategic advantage

The SEC climate disclosure rule represents a significant step toward increased transparency in the financial markets. The rule empowers investors to make informed investment decisions that consider both financial and environmental factors. It also helps position US companies as climate leaders, potentially attracting investors with strong ESG (environmental, social, and governance) priorities.

The strategic use of carbon credits can not only aid in achieving compliance with the SEC climate rule but also demonstrate a company’s commitment to a sustainable future. By supporting projects that reduce emissions and investing in innovative climate solutions, companies can mitigate their environmental footprint and build competitive advantage in the emerging low-carbon economy. Learn how Cloverly can help you prepare for SEC compliance.

To find out how to make credible climate claims with high-quality carbon credits and stay ahead of regulatory changes, register for/ watch the webinar.

i The SEC generally classifies filers by company size as follows: Large, accelerated filer: Initial public float of $700 million or more. Accelerated filer: Initial public float of $75-599 million. Non-accelerated filer and smaller reporting company (SRC): Initial public float of less than $75 million.