Picture this: you’re a company committed to making a real difference in the fight against climate change. You’ve set ambitious net-zero goals, aligned with the Science Based Targets initiative (SBTi) Net Zero Standard. But you know that tackling your entire carbon footprint, especially hard-to-abate Scope 3 emissions, is no easy feat. What if there’s a powerful tool that could help you make a bigger impact than you initially thought possible? Enter Beyond Value Chain Mitigation (BVCM). BVCM is a mechanism that enables companies to amplify the impact of their decarbonization efforts beyond their operations and supply chains by investing in global emissions reduction and removal projects. Importantly, BVCM doesn’t detract from the essential work of decarbonizing your own operations. Instead, it enhances these efforts by directing capital toward underfinanced solutions, mitigating future climate-related sourcing risks, and demonstrating climate leadership. In this article, we will decode BVCM, discuss some of its benefits, decipher how to support high-impact projects, and outline how to get started with Beyond Value Chain Mitigation.

Unlock the potential of carbon credits in your BVCM strategy. Download our white paper “7 Benefits of Carbon Credits: How to Make the Business Case” to see how they can help you accelerate your climate and business goals.

Decoding Beyond Value Chain Mitigation

Beyond Value Chain Mitigation (BVCM) empowers companies to make a real difference in the fight against climate change, reaching far beyond their own operations. The Science Based Targets initiative (SBTi) defines BVCM as “mitigation action or investments that fall outside a company’s value chain¹, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere”. In other words, it’s a smart way for businesses to invest in high-quality carbon reduction and removal projects outside their direct control. This helps to speed up the global shift to a low-carbon future and reduce long-term climate risks.

So, why should your company get involved in BVCM? Here are four compelling reasons:

✔ Demonstrate climate leadership and gain a competitive advantage

Stretching beyond your science-based targets and investing in BVCM signals your intent to mitigate climate risks and build a sustainable future. For example, you could adopt a climate strategy that allocates your budget toward more impactful solutions. By setting a higher carbon price on a portion of your annual emissions, you can focus on a carbon removal-oriented portfolio to accelerate your journey to net zero. Showing climate leadership like this can strengthen your brand reputation and lead to other business advantages such as revenue growth, reduced cost, and more.

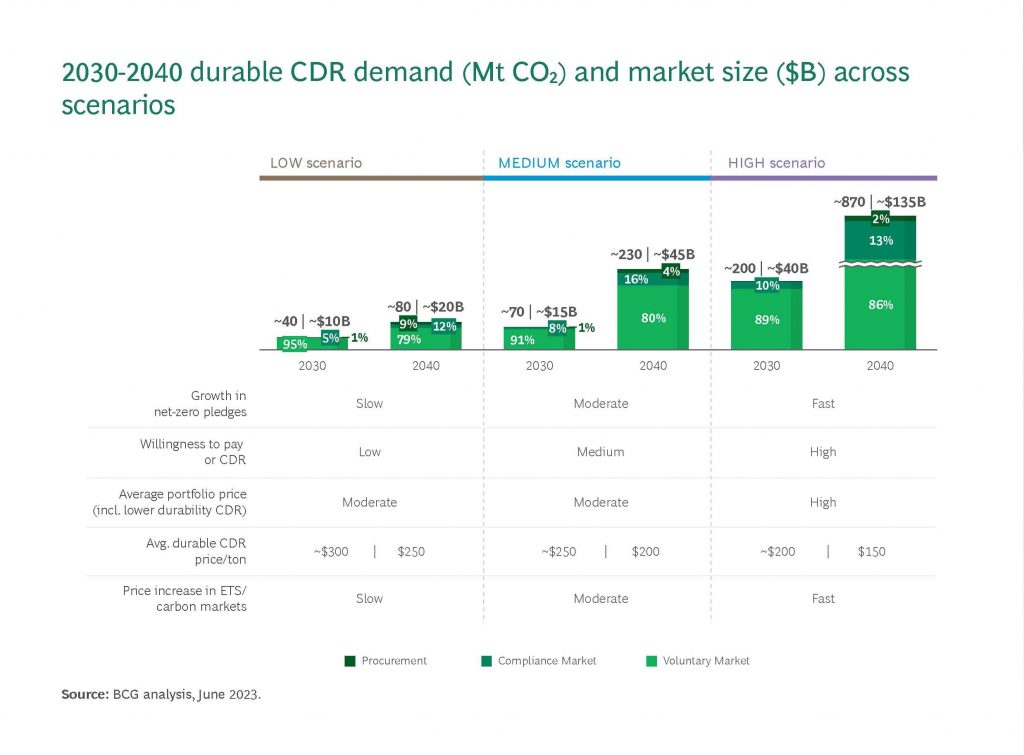

✔ Mitigate future climate liabilities and secure long-term carbon removal supply

Planning ahead and setting a BVCM budget now can help you build strategic partnerships and secure long-term offtake agreements. This proactive approach reduces the risk of limited access to the durable carbon removals you’ll need to neutralize your hard-to-abate, remaining emissions once you’ve reached your long-term science-based targets. In particular, BCG analysis estimates that annual demand will likely exceed projected supply by 2030 (see below). Annual demand is expected to be 40-200 Mt CO₂ in 2030, growing to 80-900 Mt CO₂ by 2040. By contrast, current announced projects only total ~33 Mt CO₂ by 2030. Investing today will help you meet your net-zero commitments down the line.

✔ Catalyze systemic change and drive innovation

By channeling resources into underfinanced climate solutions and emerging technologies, BVCM enables you to play a catalytic role in accelerating innovative carbon reduction and removal approaches. This helps scale up critical climate solutions and positions you at the forefront of the low-carbon transition.

✔ Integrate climate action into the core business strategy to engage stakeholders

BVCM offers a concrete way to show your commitment to environmental stewardship and social responsibility by making climate action a central part of your business operations and strategy. With customers, employees, and investors increasingly demanding meaningful climate action, embracing BVCM can give you a competitive edge by aligning with stakeholder expectations and attracting climate-conscious consumers and talent.

Choosing the right carbon credits

Not all BVCM investments are created equal. To maximize impact and credibility, you need to be selective in your approach, supporting only carbon credit projects that meet strict standards for quality and integrity.

This is where carbon project ratings, detailed evaluation, and market guidance (such as the Voluntary Carbon Markets Integrity Initiative (VCMI) Claims Code) come in.

Spotlight: The VCMI Claims Code and BVCM

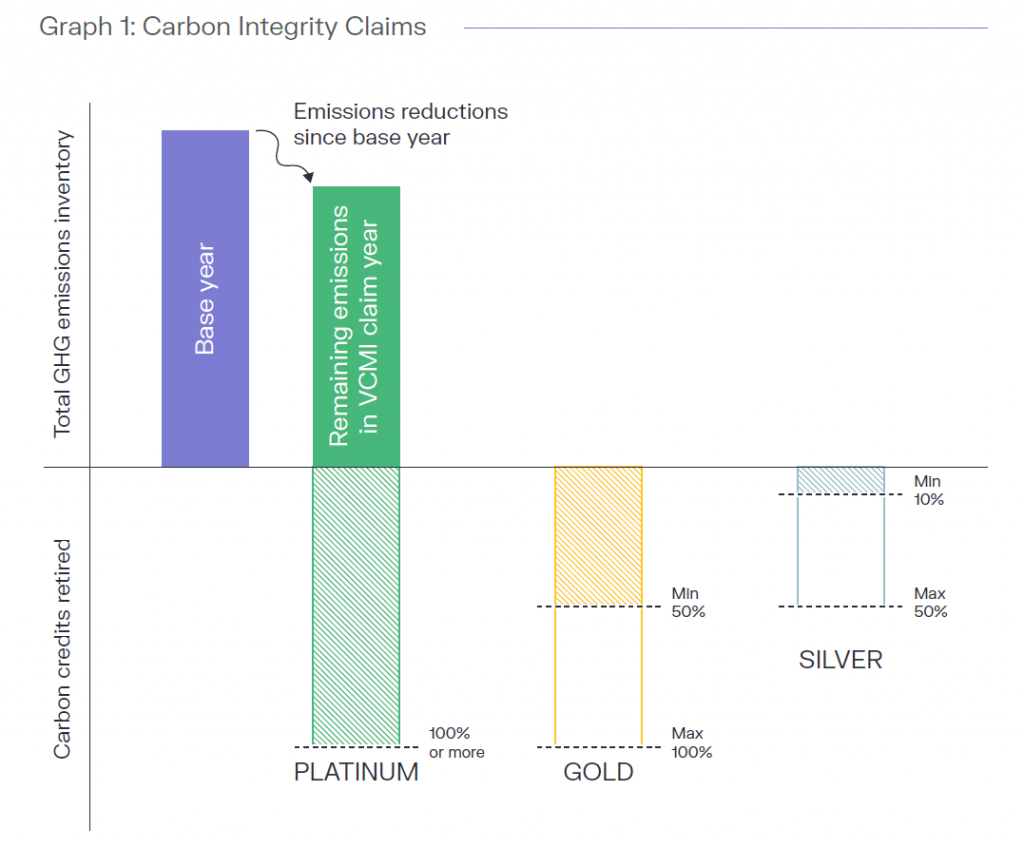

The VCMI Claims Code lays out specific requirements companies must meet to use carbon credits as part of their BVCM efforts in a credible way. Specifically, it states that companies must eventually transition to only carbon credits approved under the Integrity Council for the Voluntary Carbon Market (ICVCM)’s Core Carbon Principles (CCPs)². The claims a company can work toward include:

- Silver: the company offsets ≥ 10% and < 50% of its emissions.

- Gold: the company offsets ≥ 50% and < 100% of its emissions.

- Platinum: the company offsets ≥100% of its emissions.

Source: VCMI Claims Code of Practice

By aligning your BVCM strategies with the VCMI Claims Code, you can effectively navigate the complex landscape of projects available in the voluntary carbon markets. This ensures your investments support projects that meet established quality benchmarks. (Check out Cloverly’s VCMI Claims Webinar for more insights).

Setting a budget for Beyond Value Chain Mitigation

Now that you understand the significance of BVCM in fighting climate change, you might wonder how much to invest and how to align your budget with the latest climate science.

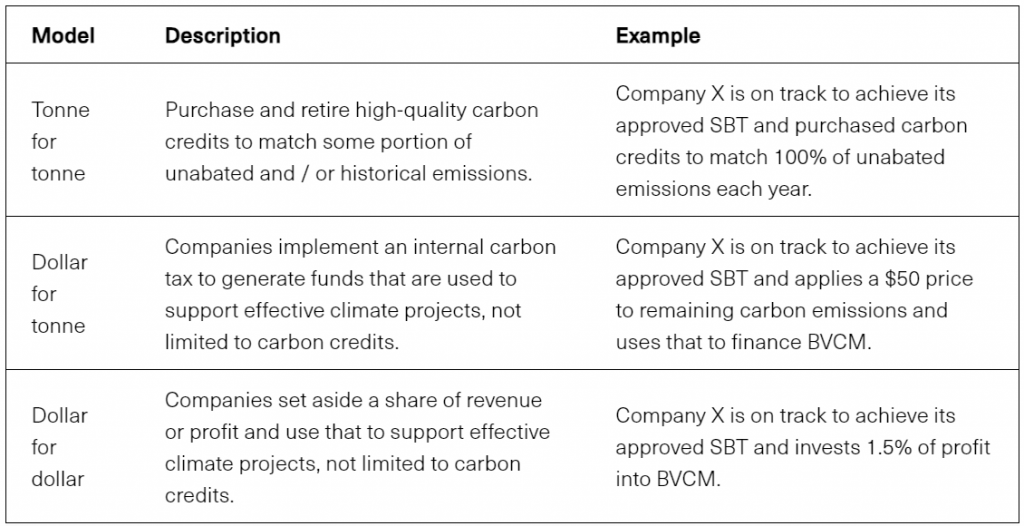

There are a few different approaches you can take to determine your BVCM budget, each with its own merits:

Source: SBTi

The Science Based Targets initiative (SBTi) provides valuable guidance on setting a financial budget for BVCM in their “Above and Beyond” report. It acknowledges that varying profit margins across different sectors and companies will affect their capacity to invest in BVCM. As highlighted above, BVCM encompasses carbon credits as well as other climate projects such as biodiversity and community-based initiatives. However, the examples below focus primarily on the purchase of carbon credits.

BVCM Carbon Credit Budget Examples

To better understand how to set a BVCM budget, let’s explore a hypothetical scenario using an imaginary company.

Suppose this company has:

- An annual revenue of $1 million.

- 1,000 tonnes (metric tons or mt) of CO₂e emissions across its scopes 1, 2, and 3.

- An operating profit margin of 20%.

We’ll consider the thought process this company may follow to set its BVCM budget.

Option 1: Using a science-based carbon price for all unabated emissions (tonne-for-tonne)

This approach allows us to consider two methods:

A. Using a Social Cost of Carbon (SCC):

This price estimates the economic damage caused by each additional ton of CO₂ emitted. Applying a SCC of $190/metric tons (mt) (as recommended by the US EPA) would result in a budget of $190,000 for the company’s BVCM activities. However, this represents 95% of the company’s operating profit, making it unlikely that the company can afford this level of investment.

B. Using a Marginal Abatement Cost (MAC)

This price estimates the cost of achieving a specific emission reduction target (e.g., the price necessary to keep warming under 1.5°C in the US). For this scenario we’ll consider a MAC of $40/mt, which falls within the $34-64/mt range for 2025 needed to limit warming to 1.5°C in the US, per Kaufman et al. (2020). This would result in a budget of $40,000 for the company’s BVCM activities. While more affordable than the SCC approach, this still represents 20% of the company’s operating profit and may be challenging to implement.

Option 2: Applying an internal carbon price for a given volume of emissions (dollar-for-tonne)

Another approach companies can take is to set an internal carbon price on a strategic portion of their emissions. This budget can then be used to purchase high-quality carbon credits for BVCM activities.

How it works

For instance, let’s say the company decides to implement a $50/t internal fee on 25% of its total 1,000 tonnes of emissions, or 250 metric tons (mt). This would equate to a $12,500 annual BVCM budget. The company could then direct those funds toward high-quality projects that help scale more nascent solutions such as direct air capture (DAC), biochar, or enhanced rock weathering (ERW). Like the other options, this BVCM budget would be invested in addition to the company’s core efforts to rapidly reduce its operational emissions in line with science-based targets.

Striking the right balance between impact and budget

Depending on the specific credits purchased and their associated costs, this $12,500 budget could support scaling solutions equivalent to 25% or more/less of the company’s annual emissions. The focus is on using this budget as an “impact fund” to support projects that extend beyond net zero commitments, rather than addressing the 250 metric tons precisely. By applying a higher internal carbon price on select emissions, the company can ensure impactful BVCM investments within a manageable budget. Over time, the company could consider gradually raising the internal price level and/or expanding the percentage of emissions covered as its capacity grows.

Option 3: Determining the company’s ability to pay for a strategic volume of emissions (dollar-for-dollar)

Some companies may be unable to allocate a budget as outlined in the first two recommended approaches. In that case, a third option would be to simply assign a budget based on a share of profit. Companies taking this approach should plan to increase the percentage over time until they are achieving the levels in the first two options. For this scenario, suppose the company decides it can contribute 4% of its operating profits to BVCM activities.

- This results in a budget of $8,000.

- In this case, the average carbon price for the company’s BVCM activities would be $8/mt.

Carbon credit price vs. volume for impact

Given the limited options at this price, the company may consider a different approach. Instead of targeting 1,000 metric tons (mt), they could target a smaller volume such as 200 mt to increase the average carbon price to $40/mt. As long as the company is reducing emissions in line with its science-based targets (SBTs), this can serve as a climate contribution tactic for BVCM activities. Once the long-term SBT is achieved, durable removals will still be necessary for residual emissions. However, this strategy enables the company to take immediate climate action by supporting impactful solutions beyond its operations, thus delivering broader impact.

- In this scenario, the company has offset 20%³ of its emissions. If it meets the criteria⁴, it could make a silver claims code under the VCMI.

These examples demonstrate how companies can approach setting a BVCM budget based on their financial capabilities and emission reduction goals. By carefully considering their options and adopting a strategic approach, companies can make meaningful contributions to climate action while ensuring the financial viability of their BVCM investments.

Real-world BVCM strategies in action

Many companies are adopting internal carbon pricing as a way to fund Beyond Value Chain Mitigation (BVCM) initiatives. One common method is the use of an internal “shadow carbon price,” which estimates potential future costs from carbon regulations to prioritize BVCM investments. For example, by setting an ambitious carbon price on a portion of their verified emissions, companies can allocate capital toward carbon removal solutions. This strategy ensures they have access to the robust carbon removals needed to neutralize future hard-to-abate residual emissions.

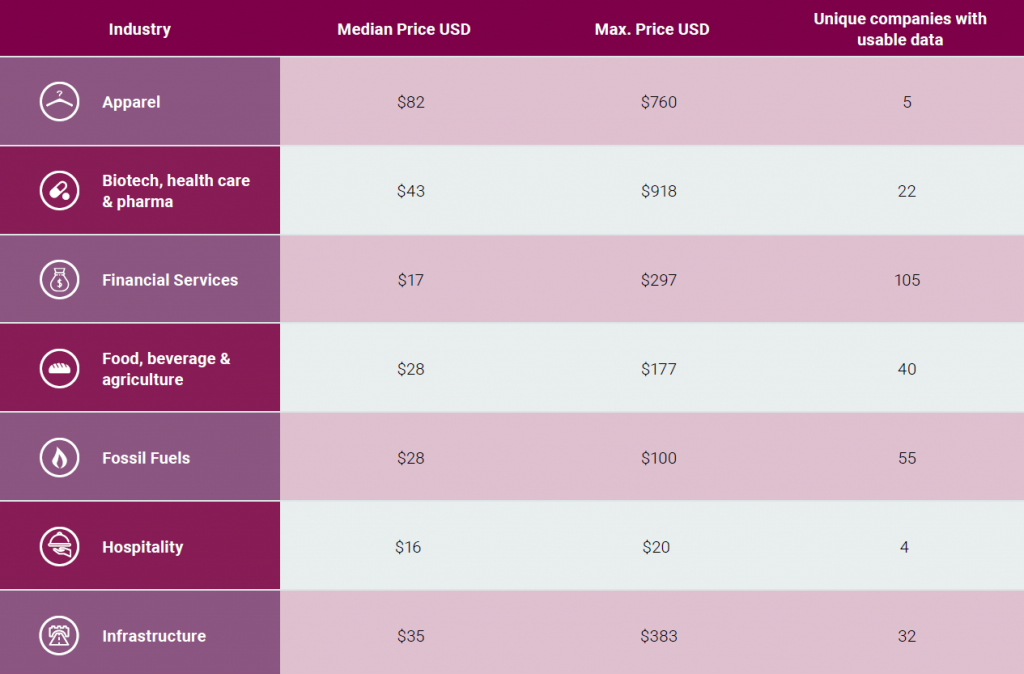

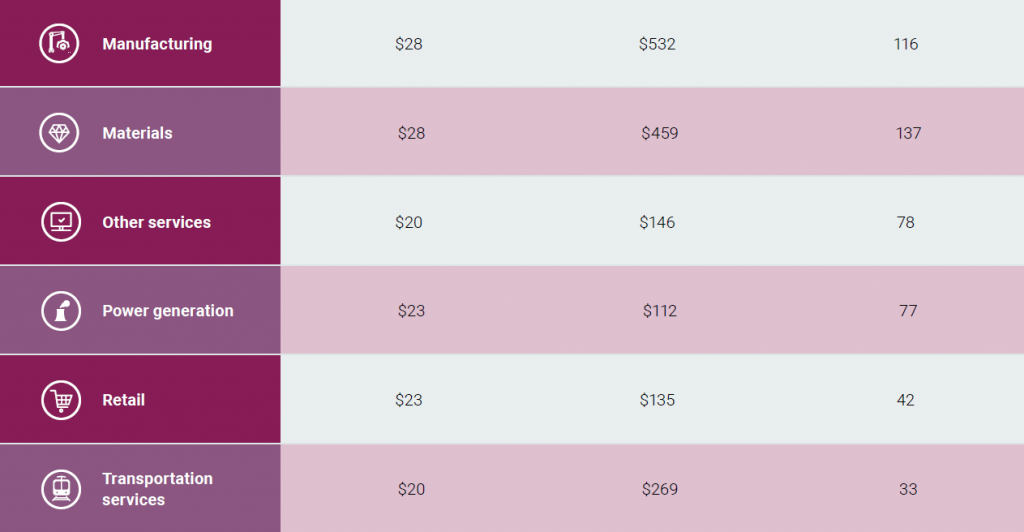

Internal carbon prices by industry

The diagram below provides some insight into the variation of internal carbon pricing by different sectors:

Source: CDP

Benefits of internal carbon pricing

Setting a higher internal carbon price helps mitigate regulatory risk for companies as they work to achieve their net-zero targets. Many analysts expect steadily rising compliance costs for emissions as carbon pricing regulations expand and prices increase over time. By stress-testing your investments against an elevated shadow price today, you can help future-proof your climate strategies and BVCM budgets. This ensures you pursue enough removals through BVCM activities to achieve net-zero targets cost-effectively. An internal carbon price set closer to the social cost of carbon or MAC provides a more conservative risk mitigation approach.

Case study: Microsoft

One company that’s had a strong track record of success in setting internal carbon pricing is Microsoft. One of the first companies to adopt voluntary internal carbon pricing, Microsoft has used it to accelerate its decarbonization efforts. Since 2012, the company has been using an internal carbon fee model, requiring each business division to pay a fee based on its emissions levels. In 2020, Microsoft announced an ambitious goal to become carbon-negative by 2030. To support this goal, the company expanded the scope of its internal carbon price to include all Scope 3 emissions from suppliers and product use. The fee is set at a level aimed at driving meaningful impact by funding Microsoft’s carbon reduction and removal efforts while also accounting for company growth. For fiscal year 2023, Microsoft increased the internal Scope 3 fee to $100/mt specifically for business travel emissions to better support sustainable aviation fuel (SAF) purchases. The company plans to continue raising its internal carbon fee at an accelerated rate through 2030 to match projected future carbon abatement costs.

BVCM: Accelerating the transition to a sustainable world

Beyond Value Chain Mitigation (BVCM) is a powerful tool for companies to amplify their climate impact and drive meaningful change beyond their own operations. By strategically investing in high-quality carbon reduction and removal projects, businesses can demonstrate climate leadership, mitigate future risks, catalyze innovation, and engage stakeholders. Setting a BVCM budget aligned with the latest climate science and best practices ensures that your efforts are both impactful and credible. As we race toward a net-zero future, BVCM offers a compelling opportunity for companies to accelerate the transition and create a more sustainable world.

How Cloverly can help

Cloverly’s platform can help simplify the process of purchasing vetted, high-quality carbon credits. We’ve developed our own Cloverly In-house Risk and Quality Standard (CIRQS) to assess the integrity of the credits on our platform. CIRQS involves a detailed evaluation of 53 key risk measures, covering project and developer, registry, methodology, political, and external risks. Plus, we’ve partnered with three leading carbon credit rating agencies (BeZero, Calyx, and Sylvera) to bring you comprehensive and reliable assessments.

So, whether you’re just getting started with BVCM or looking to enhance your existing pledge, we’re here to help. Reach out to us today, and let’s work together to create a tailored solution that meets your unique needs and helps you achieve your climate goals. Together, we can make a real difference!

Discover how carbon credits can amplify your BVCM strategy while driving climate and competitive leadership. Download the white paper “7 Benefits of Carbon Credits: How to Make the Business Case”

¹The value chain is the process(es) by which a company adds value to its raw materials to produce products, eventually to be sold to customers. This is different from the supply chain, which represents all the steps required to get the product to the customer. (Source: Investopedia)

²For VCMI Claims made on or after January 1, 2026, companies must exclusively purchase and retire CCP-approved credits to comply (Source: VCMI Claims Code of Practice – November 2023 version)

³The SBTi suggests that companies could use a portion of their BVCM budget each year to deliver quantified mitigation outcomes equivalent to at least 50% of the company’s unabated scope 1, 2, and 3 emissions. This is presented as an illustrative example rather than a definitive recommendation.

⁴ To make a VCMI claim, companies must comply with the VCMI Foundational Criteria, select a VCMI Claim, meet the required carbon credit use and quality thresholds, and obtain third-party assurance following the VCMI Monitoring, Reporting & Assurance (MRA) Framework.